The 2022-23 federal Budget was handed down on 25 October. The confirmation of lucrative income tax cuts, and the scrapping of a tax offset for low- and middle-income earners were the big-ticket items.

That said, Labor’s first federal Budget in nine years was as noteworthy for the changes it didn’t make as for those that it did. Unmentioned were current outstanding issues impacting the taxation of trusts, the long-awaited simplification of 7A, the future of business depreciation after this financial year and more.

Business and Individual Taxation

Briefly the key taxation measures announced in the Budget are summarised as follows.

- Digital currencies not a foreign currency – the Budget Papers confirm that the government is to introduce legislation to clarify that digital currencies (such as Bitcoin) continue to be excluded from the Australian income tax treatment of foreign currency.

- COVID grants treated as NANE – the Budget Papers contain a listing of further State and Territory COVID-19 grant programs eligible for non- assessable, non-exempt treatment.

- LMITO axed – the government did not announce any extension of the low- and middle-income tax offset (LMITO) to the 2022-23 income year. The LMITO has now ceased and been fully replaced by the less lucrative and less available low income tax offset (LITO). The March 2022-23 Budget had increased the LMITO by $420 for the 2021-22 income year so that eligible individuals (with taxable incomes below $126,000) received a maximum LMITO up to $1,500 for 2021-22 (instead of the previous $1,080).

- No action – the government did not make any announcements around outstanding issues such as the long-awaited changes to Division 7A, reform to section 100A, the extension of both Temporary Full Expensing and loss carry-back (both due to expire at the end of June 2023), and implementation of the Board of Taxation’s recommendations around changes to the individual tax residency rules.

- Thin Cap – the current measures impose a restriction on the deductibility of foreign held debt under a balance sheet approach. The proposed Thin Cap measures will replace the safe harbour test with a new earnings-based test under which an entity’s debt-related deductions will be limited to 30% of profits (using earnings before interest, taxes, depreciation and amortization (EBITDA) (as the measure of profit); allow deductions denied under the EBITDA test to be carried forward and claimed in a subsequent income year (up to 15 years) and replace the worldwide gearing test and allow an entity in a group to claim debt deductions up to the level of the worldwide group’s net interest expense as a share of earnings (which may exceed the 30% EBITDA ratio). These measures are proposed to commence on 1 July 2023.

- Share buy-backs – the government intends to align the tax treatment of off-market share buy-backs undertaken by listed public companies with the treatment of on-market share buy-backs. However, there is no detail in the Budget Papers nor in any associated media releases as to what precisely is intended.

- Depreciation of intangible assets – the government will not proceed with the proposal to allow taxpayers to self-assess the effective life of intangible depreciating assets. This is the reversal of the previously announced option to self-assess effective life for certain intangible assets (e.g. intellectual property and in-house software). The effective lives of such assets will continue to be set by statute.

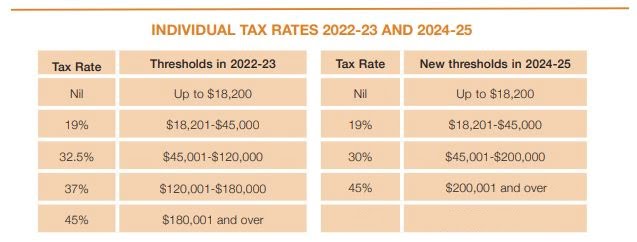

- Individual tax rates – the government did not announce any personal tax rates changes. The Stage 3 tax changes commence from 1 July 2024, as previously legislated. From 1 July 2024, Stage 3 will see the abolition of the current 37% tax bracket, lowering the existing 32.5% bracket to 30%, and raising the threshold for the top tax bracket from $180,001 to $200,001.

Consequently, the first $18,200 you earn will be tax-free (as it is currently), and every dollar you earn between that and $45,000 will be taxed at 19% (as it is currently).

However, things then change from 1 July 2024 where every taxable dollar you earn from $45,001 to $200,000 will be taxed at 30%, and every dollar you earn above $200,000 will be taxed at 45%.

Please see the table below.

Superannuation and Retirement

CAPS AND LIMITS UNTOUCHED

In a pleasing development, the important superannuation caps and limits were undisturbed, providing all-important investor certainty moving forward. This means that:

- individuals will be permitted to contribute just as much to superannuation as currently under the concessional and non-concessional caps at $27,500 and $110,000 respectively (or up to $330,000 of non-concessional contributions over three years, subject to an individual’s total superannuation balance (TSB))

- The TSB cap is unadjusted at $1.7 million and indexation continues. The retention of indexation means that the cap will very likely increase by $200,000 to $1.9 million from 1 July 2023. The TSB is relevant when working out eligibility for the following super-related measures:

- Carry-forward concessional contributions

- Non-concessional contributions cap and the bring-forward of your non-concessional contributions cap

- Work test exemption

- Government co-contribution

- Spouse tax offset

- Segregated asset method for calculating exempt current pension income.

- Frozen deeming rates will be retained starting at 0.25% until 30 June 2024. The deeming rules are used to work out the income for your financial assets including superannuation. The rules assume these assets earn a set rate of income, irrespective of what you really earn. On 1 July 2022, the deeming rates were frozen for a further two years for all people receiving Centrelink payments, including approximately 445,000 Age Pensioners. Therefore, even though interest rates have increased significantly in 2022 and may do so further, the current deeming rates are sheltered until at least the middle of 2024.

DOWNSIZER AGE REDUCTION

The government confirmed its election commitment that the minimum eligibility age for making superannuation downsizer contributions will be lowered to age 55 (down from age 60). Legislation in the form of the Treasury Laws Amendment (2022 Measures No.2) Bill 2022 is currently before Parliament to effect this change. When passed into law (a safe assumption given that this is a bipartisan measure) the reduced age limit will apply from the first day of the first quarter after the day the Bill receives Royal Assent (likely from 1 January 2023). There is no maximum age limit to make a downsizer contribution.

Individual Tax Rates 2022-23 And 2024-25

This change will allow individuals aged 55 or over to make an additional non-concessional contribution of up to $300,000 from the proceeds of selling their main residence outside of the existing Contribution caps. Either the individual or their spouse must have owned the home for 10 years.

Downsizing will also be Incentivized. Pensioners who downsize will have their sale proceeds exempt from the asset test extended from 12 to 24 months. Further, for income test purposes, Only the lower deeming rate (currently 0.25%) will apply to the asset test exempt principal home proceeds for the 24 month period.

Expanded access to the commonwealth seniors health card

The government re-stated its commitment to increase the income threshold for Commonwealth Seniors’ Health Card eligibility from $61,284 to $90.000 for singles and from $96,054 to $144,000 (combined) for couples.

Other announcements

- The SMSF audit cycle will not be expanded to three years. The annual audit requirement remains.

- The relaxing of the SMSF residency rules, previously announced in the 2021-22 Budget to commence from 1 July 2022. will now start from the income year commencing on or after the date of assent of the enabling legislation ( yet to be introduced). Therefore, SMSF trustees need to ensure that day satisfies the current residency requirements otherwise their fund may become non- complying with severe tax consequences to follow.

If you have any questions About how any of the above may impact you or your SMSF, Please contact us.