As we all know, the Australian tax rates 2024 are ever-changing, and staying true to their reputation Australian tax brackets 2024 are going to change! In a move that reflects both economic anticipation and a move to social equity, the Australian Labor government has undertaken a significant revision of the Stage 3 tax cuts. As the nation contends with inflation and a cost-of-living crisis, these amendments are intended to redefine how Australians experience taxation.

What tax bracket 2024 do you fall into? How will the tax margins 2024 affect you? Are there new concessions that could benefit you? What are the long-term projections for the stage 3 tax cut revisions? Will this new move alleviate some of the economic hurdles faced by women? We’ve crafted a short, easy-to-follow overview to put these questions to rest. Read along to find out more!

The Tax Reform Tightrope: Australia’s Stage 3 Tax Cuts Redesign

Bracket | Income range | Marginal Tax Rate | Tax payable |

1 | $0-$18,200 | 0% | Nil |

2 | $18,201-$45,000 | 19% | 19% of excess over $18,200 |

3 | $45,001-$120,000 | 32.5% | $5,092 + 32.5% of excess over $45,000 |

4 | $120,001-$180,000 | 37% | $29,467 + 37% of excess over $120,000 |

5 | $180,001+ | 45% | $51,667 + 45% of excess over $180,000 |

The Original and the Overhaul

Initially, the Stage 3 tax cuts were set to simplify the tax system by reducing the number of tax brackets 2024. This initiative would have seen the 32.5% and 37% tax brackets merge into a single 30% bracket for incomes between $45,001 and $200,000. Here’s a look at the original plan:

Bracket | Income Range | Marginal Tax Rate | Tax Payable |

1 | $0-$18,200 | 0% | Nil |

2 | $18,201-$45,000 | 19% | 19% of excess over $18,201 |

3 | $45,001-$200,000 | 30% | $5,092 + 30% of excess over $45,000 |

4 | $200,001+ | 45% | $51,592 + 45% of excess over $200,000 |

However, the redesign changes the script. It compresses the tax benefit for high earners and extends the 30% bracket up to $135,000, thus modifying the relief across different income ranges. Here’s what the new Australian tax rates 2024 structure looks like:

Bracket | Income Range | Marginal Tax Rate | Tax Payable |

1 | $0-$18,200 | 0% | Nil |

2 | $18,201-$45,000 | 16% | 16% of excess over $18,201 |

3 | $45,001-$135,000 | 30% | $4,288 + 30% of excess over $45,000 |

4 | $135,001-$190,000 | 37% | $31,288 + 37% of excess over $135,000 |

5 | $190,001+ | 45% | $51,638 + 45% of excess over $190,000 |

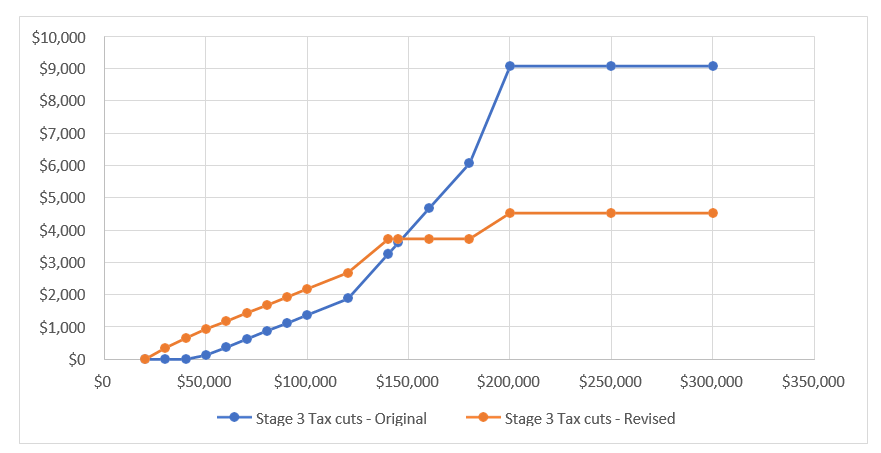

Analysing the Winners and Losers of New Australian Tax Rates 2024

The revised tax plan has a more pronounced progressive structure, where the tax relief is skewed towards low and middle-income earners. For instance, individuals earning $40,000 will see a tax cut of $654, a benefit that did not exist in the original plan.

On the other hand, those at the higher end of the income scale, such as individuals with a taxable income of $190,000, will receive about $4,500, roughly half of what they would have received under the previous structure.

Revenue Implications

The immediate cost to the budget due to these changes is estimated at $1.3 billion over four years. However, in a longer-term view, these changes are expected to add an extra $28 billion in tax revenue over a decade. Such projections suggest a strategic approach that weighs short-term expenditure against long-term fiscal stability.

A Closer Look at Gender and Inequality

The tax cuts are not just numbers on a spreadsheet; they have real-world implications for gender equality. With the average tax cut for female taxpayers increasing to $1,649, the government acknowledges the disproportionate economic hurdles faced by women, particularly in lower- income brackets.

The Cost of Tax Cuts

The Stage 3 tax cuts come with a heavy price tag, potentially costing nearly $313 billion over a decade. This raises critical questions about the opportunity costs of such a tax policy, especially when considering the funding requirements for public services like Aged Care and Education.

Visualizing the Change

To better understand the impact of the Stage 3 tax cuts redesign, visual aids can be particularly illuminating. Charts that compare the tax payable before and after the redesign across different income brackets would highlight the redistribution of tax relief.

Do you have any questions regarding the new Australian tax rates 2024? Perhaps you’re wondering how to manage your tax liability this year or you want to maximise your deductions and claim every dollar that you can! Whatever your situation may be, our tax experts are here to help! Give us a call on 1300 260 360 and let’s get started!